Where Do I Send Estimated Tax Payments For 2025

Where Do I Send Estimated Tax Payments For 2025. Iras will send customised sms reminders with your property address, tax amount to be paid and property tax reference. View the amount you owe, your payment plan details, payment history, and any scheduled or pending payments.

Alternatives to mailing your estimated tax payments to the irs; In most cases, you must pay estimated tax for 2025 if both of the following apply:

If you made estimated or quarterly tax payments in 2025 toward your federal, state, or local taxes, enter them in the estimates.

Estimated (Quarterly) Tax Payments Calculator Bench Accounting, Estimated taxes are “pay as you go,” according to the irs, and are spread across four payments. If you get the no payments screen instead, you don't need to make.

Find Out The Penalty For Not Making Quarterly Tax Payments, Make a same day payment from your bank account. The estimated tax payments are due quarterly.

How to calculate estimated taxes 1040ES Explained! {Calculator, Your 2025 income tax return. Make a same day payment from your bank account.

What To Do If You Miss a Quarterly Tax Payment, Solved•by turbotax•3228•updated january 19, 2025. Your property tax payment is due on 31 jan 2025.

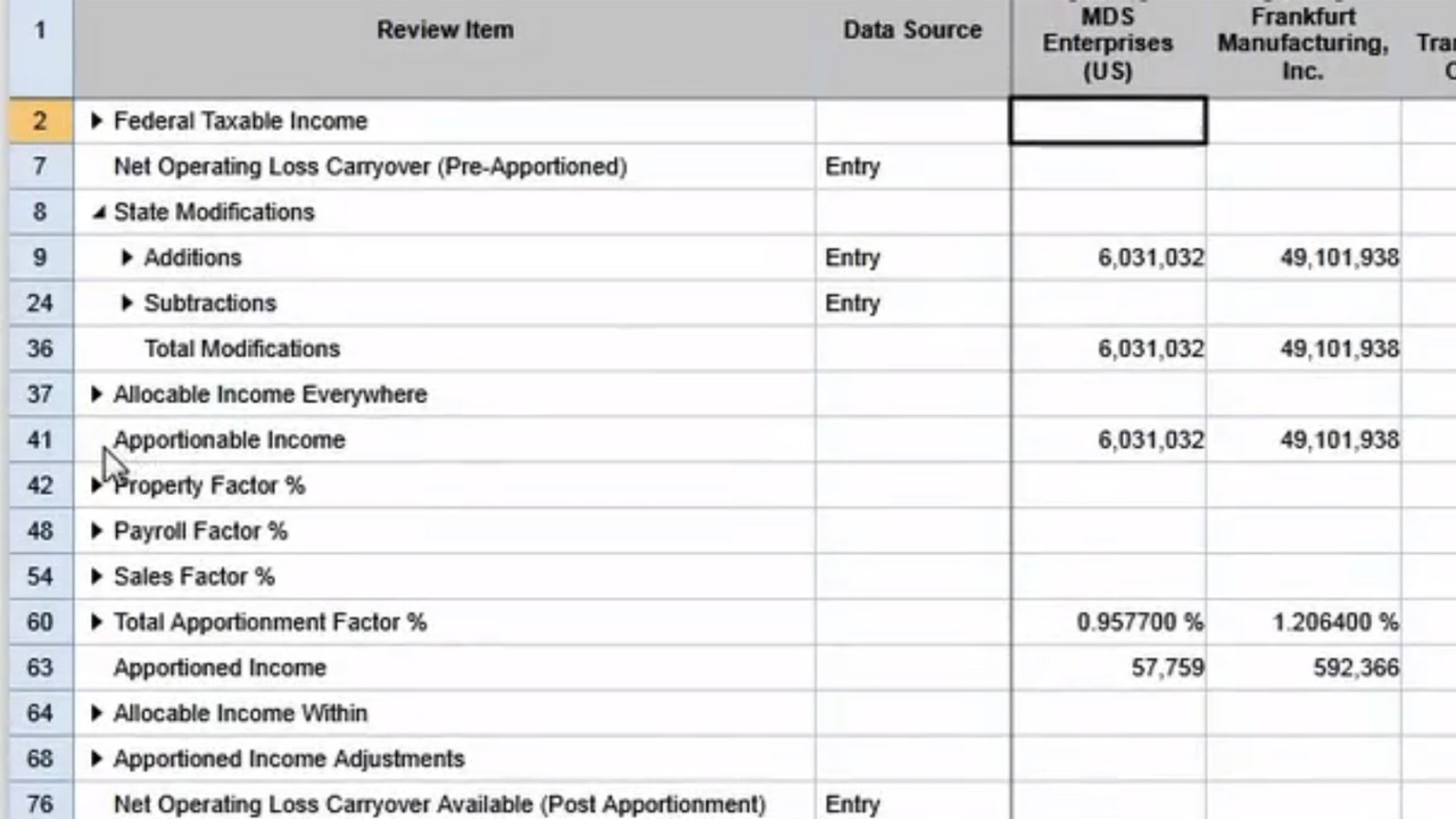

Estimated tax payments software by Thomson Reuters ONESOURCE Thomson, Iras will send customised sms reminders with your property address, tax amount to be paid and property tax reference. And those dates are roughly the same each year:

IRS Refund Schedule 2025 When To Expect Your Tax Refund, Iras will send customised sms reminders with your property address, tax amount to be paid and property tax reference. Solved•by turbotax•19411•updated 2 weeks ago.

Important tax deadline for 2025 payments is tomorrow act now or face, For taxpayers who are required to make estimated tax payments, it is important to be aware of the irs deadlines. Additionally, if you submit your 2025 federal income tax return by jan.

Reducing Estimated Tax Penalties With IRA Distributions, You'd expect to owe at least $1,000 in taxes for the current year (after subtracting. The deadline for payments due april 15, 2025,.

What are Estimated Tax Payments & How Do You Make Them?, The estimated tax payments are due quarterly. Extension payments, estimate payments, regular tax liability.

“I Just Love Paying Extra Money to the IRS!” said nobody ever. Team, The tool is designed for taxpayers who were u.s. Individuals and businesses impacted by the san diego county floods qualify for an extension to pay their april estimated tax payment.